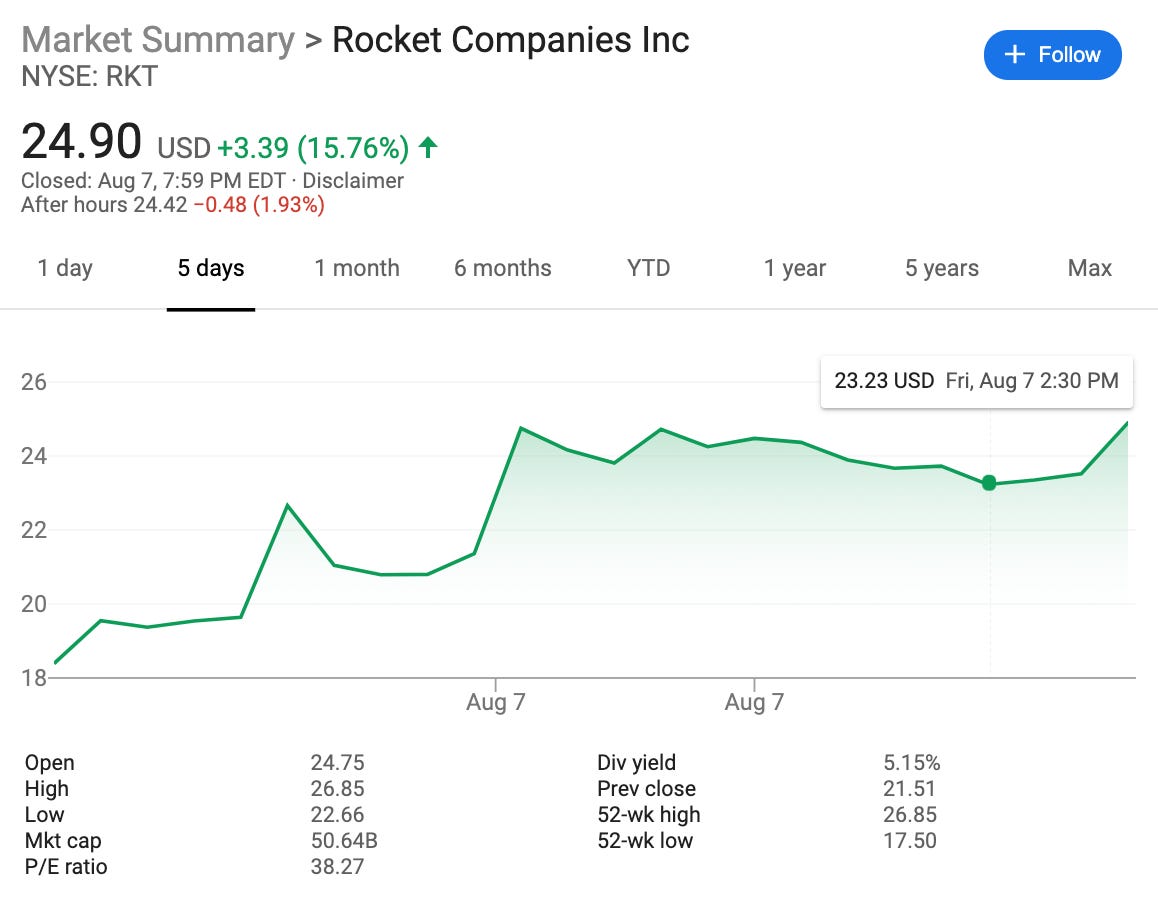

Stock Pick of the Week: Rocket Companies $RKT

The nation's largest mortgage lender IPO'd last Thursday - should you buy?

For those joining in for the first time, welcome! Pocket Change is a newsletter where Tony + Karine keep track of and analyze stocks we think are noteworthy (and whether we should invest pocket change into). We’ve been friends since 2013, and have been sending each other stock suggestions and portfolio screenshots over the years. Pocket Change is our way of opening up the conversation and sharing these ideas more publicly. This newsletter goes out every weekend with our analysis and decision for a new stock.

To receive this newsletter weekly, consider subscribing 👇

Summary

🚀$RKT: Parent Company of largest mortgage lender in the US: Quicken Loans

🥳IPO’d at $18/share last Thursday

🏡Q2 2020: $72.3 billion originated in loans, up 40% from Q1

👀Enterprise Value: $62.3B

💰EV/Adjusted EBITDA (NTM): 8.5x

Rocket Companies ($RKT), the parent company of major mortgage lender, Quicken Loans, and online mortgage application process, Rocket Mortgage, IPO’d on Thursday morning and jumped as much as 26% on opening day.

Rocket Companies is a Detroit-based holding company that consists of many businesses, most notably Quicken Loans and Rocket Mortgage. As the largest mortgage lender in the U.S., the company has provided more than $1T in home mortgage loans since its inception in 1985, and currently maintains a current market share of 9.2% in the $2 trillion annual market, growing at a 19% CAGR in processed volume.

The ease of applying for a mortgage via Rocket Mortgage’s digital platform and iPhone app has allowed for Rocket Companies to experience tremendous growth in direct-to-consumer loans in the last few years, especially among Millennials. Q2 2020 saw a record $72.3 billion originated in loans, up 40% from Q1, and more than double the amount in Q1 2019. In this post, we look at if Rocket Companies will be able to continue its growth and dominance in market share.

Did you know?

Dan Gilbert is the founder and chairman of Quicken Loans and has been since its inception in 1985; he’s been a true pioneer in the digitization of mortgages. In addition, he is also the owner of the National Basketball Association's Cleveland Cavaliers and highly involved in many efforts and companies in the city of Detroit and Cleveland. The main impetus of going public was to raise money to continue to scale the company by purchasing businesses, but also to allow Gilbert to take out a small amount of equity to invest into Detroit and Cleveland.

Fundamentals

Enterprise Value: $62.3B

EV/Adjusted EBITDA (NTM): 8.5x

2019 Revenue: $5.1 billion

Adjusted EBITDA Margin: 43.6%

Current Market Share: 9.2% in the $2 trillion annual market, growing at a 19% CAGR in processed volume.

Sponsored Section: We wanted to share a stock investing app we’ve been loving called Public. Public makes the stock market social (think Robinhood meets Twitter - where you can follow other investors, see what they’re investing in, and then actually invest). We’ve been adding more analyses + our Pocket Change portfolio there, so join us! We may receive compensation from affiliate links.

How Rocket Companies Makes Money

In 2019, Rocket Companies made more than $5.1 billion in revenue, with this number expected to 4x in 2020. Because Rocket Companies is a holding company, they make money from all of their various businesses in their ecosystem, depending on the business model.

Rocket Mortgage - (83% of total revenue) The online mortgage application platform where users can apply for a mortgage and get real-time quotes via online or phone. Revenue from Rocket Mortgage are generated from the gain on sale of loans, which includes loan origination fees, revenues from sales of loans into the secondary market, and the fair value of originated mortgage servicing rights (MSRs) and hedging gains and losses. In fact, their business model is high-velocity and capital light because they originate mortgage loans that are sold either to government-backed entities or to investors in the secondary mortgage market, and are sold within three weeks of origination.

In addition to the loan revenue, Rocket Mortgage also services the loans, meaning they are responsible for the processing of monthly mortgage payments, managing escrow accounts and reporting loan and pool information to investors. This generated $950M in 2019.

Other Rocket Companies (17% of total revenue in 2019 ($977.7 M))

Amrock - (57% of Other Rocket Companies 2019 revenue ($558.6 M)) - Amrock is a provider of title insurance services, property valuations and settlement services, which help to streamline and clarify the real estate experience across the appraisal, title and closing process and close mortgage loans as quickly as possible.

Core Digital Media - (25% of Other Rocket Companies 2019 revenue ($237.2 M)). An online marketing and lead generation service provider in the mortgage, insurance and education sectors, which operates a variety of sites like LowerMyBills.com and generates over six million client leads for itself and third parties.

Rock Connections + Rocket Auto (12% of Other Rocket Companies 2019 revenue ($114M)) - a sales and support platform specializing in inbound and outbound contact center services, existing primarily to strengthen brand reputation and support the other businesses with high-quality client service. Rocket Auto provides this centralized and remote car sales support to national car rental and online car purchasing platforms with substantial inventories. The business earns fee revenue based on the volume of car sales as well as the sale of additional ancillary products and services such as auto financing, facilitating nearly 20,000 car sales in 2019.

Rocket Homes (4% of Other Rocket Companies 2019 revenue ($43.1M)) - Through Rocket Homes, prospective clients can search for homes online, find a real estate agent or seamlessly connect to Rocket Mortgage to seek financing for their homes.

Rocket Loans (2%of Other Rocket Companies 2019 revenue ($24.8M))- an asset-light, online-based personal loans business that focuses on high quality, prime borrowers to receive same day funding. Rocket Loans also provides technology as a white label solution to other loan providers, by modifying or creating technology to meet clients' specifications. Rocket Loans receives fees on a fixed and/or variable basis for this work.

Lendesk and Edison Financial (still new) - Rocket's first international expansion leveraging its technology in Canada. Lendesk is a loan origination platform that provides a point of sale system for mortgage professionals and a loan origination system for private lenders, and Edison Financial is a digital mortgage firm that will use Lendesk's Spotlight as its lender submission platform of choice.

Growth opportunities

Refinancing Boom. Mortgage rates have dropped to historical lows, which means a majority of homeowners can save money by refinancing their mortgage. Today, the U.S. has $10.7 trillion mortgage loans outstanding. The benchmark 30-year mortgage stands at 3.14%, which means that over 90% of the loan can be lowered by refinancing. Furthermore, with local banks closed due to COVID-19, homeowners are more likely to find Rocket Companies services online. Today, Rocket Companies has over 11% of refinancing market share (vs. 3% for home buying), and we expect this to grow this year and next year.

Millennial Home Ownership. There are 68 million Millennials between the age of 20-34, and only 32% of them are homeowners today. In the early 2010s, Millennials flocked to the city, chose to rent instead of buying homes, and delaying significant life milestones (e.g. family formation). However, the second half of the decade saw increased migration out of cities into suburbs, and recently this trend is accelerated by COVID-19. With record low mortgage rates, Millennial home ownership is likely to increase, and Rocket Companies is well positioned to capture this demand with their online and mobile app presence and top-rated customer service.

Competitors / Risks

Vertically Integrated Competitors. Zillow and Redfin are two online lead generation businesses that have recently started offering more vertically integrated solutions, such as mortgage origination and software solutions. Similar to Rocket Companies, they package the loans and sell them on the secondary market.

Technology Competitors. Ellie Mae is a private company offering lending software solutions. International Continental Exchange, the owner of NYSE, announced this week that they were acquiring Ellie Mae for ~$11 billion in enterprise value to complement their existing closing/post-closing solutions (e.g. title transfer). While not directly competitors, ICE could strength the technology infrastructure of other mortgage originators and make them more competitive against Rocket Companies.

Duration of the Refinancing Boom. Record low interest rates are fueling a refinancing boom. If the mortgage rates start to rise again, then refinancing activity could slow dramatically and cut into Rocket Companies’ growth. The mortgage rates are tied closely to the U.S. Treasuries, such as the 10-year notes.To illustrate the connection, an investor would compare the return on the 10-year compared to a mortgage loan. If the government decides to raise interest rates, then the investor might get a better rate on the 10-year, and therefore the mortgage interest rate has to correspondingly rise as well to remain competitive. We’d recommend monitoring the actions of the U.S. Federal Reserve closely for change in interest rate policy, and would view rising interest rates as negative for refinancing activity.

Voting Control. The Chairman of the Board, Dan Gilbert, controls ~79% of the company, so it will be difficult for common shareholders to exert control over corporate governance matters. Furthermore, Dan Gilbert's wife also serves on the board. While generally not an issue during good times, it could come to bite the shareholders in bad times if there are disagreements over strategic decisions (e.g. executive compensation, M&A).

Key Questions to Ask Yourself (before we think you should buy...)

How long do you think mortgage rates will stay low and sustain refinancing activities before moving higher?

Can Rocket Companies continue to gain market share in a fragmented but relatively mature industry, where its competitors are catching-up in terms of technology?

Our Take

Rocket Companies is the largest mortgage lender in the US and is clearly in this for the long-run, with a solid foundation for continued success. We think Rocket Companies is a decent way to get exposure to the refinancing boom and rising homeownership trends among Millennials, and is a great buy.

Note this is not investment advice. Please consider doing your own research before making any investments!

If you’re finding this newsletter valuable, consider sharing it with friends, or subscribing and following us on Twitter if you aren’t already. If you have any feedback / comments / suggestions for what you’d like us to analyze, please share with us as well!